UK:Property market soars 10% in year to March as average UK house price jumps £4k in a month

Property prices increased by 9.6 per cent in the year to March 2015, up from 7.4 per cent recorded the previous month, official figures show.

It is the first time annual growth figure has risen since last summer. From September 2014 onwards, yearly house price inflation has slowly dropped in each consecutive month, from a high of 12.1 per cent.

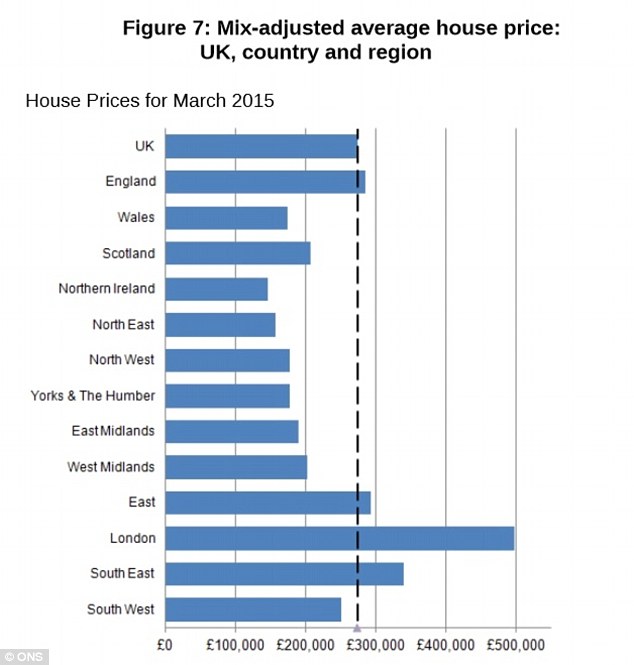

But unlike last summer, the latest rise isn’t solely down to a crazy market in London. It was actually Scotland which saw yearly prices rise the fastest in March, with growth of 14.6 per cent.

This is followed by the East at 11.4 per cent, and then then the South East and London at 11.2 per cent.

Excluding London and the South East, UK house prices increased by 8.1 per cent in the 12 months to March 2015 – a far higher percentage than usually recorded, showing values are strengthening across the country.

he rise means the average property value in March reached £273,000, according to the Office for National Statistics. This is £4,000 higher than February and just £1,000 off the record high from August last year.

House price annual inflation was 9.4 per cent in England, 5.7 per cent in Wales and 7.5 per cent in Northern Ireland. The 14.6 per cent growth in Scotland was the highest annual increase north of the border since July 2007.

The March boom means a number of regions now have properties values at record highs, including the East, East Midlands, West Midlands, South East and the South West.

London is still slightly behind the prices it recorded in August 2014.

Now that the general election is over with, prices could fire higher in the coming months. The ONS data lags a month behind other indexes.

Tom Harrington, managing director of online estate agents, House Tree, said: ‘The ONS data is pretty historic as the housing landscape has changed dramatically since March.

‘Now that the general election is out of the way, and all the uncertainty surrounding it which saw buyers and sellers alike sit on their hands, the handbrake has been released on activity and confidence.’

Alex Gosling, chief of online estate agents House Simple, said: ‘Buyer interest has picked up noticeably in the past week. We will have to wait and see if this is just a slingshot effect of the general election.

‘The issue over the past few months has never really been about demand, because the buyers have always been there.’

The latest monthly property index from Halifax said the average property price now stands at a record £196,412 – up £3,084 compared to March, when house prices had grown by a slower monthly rate of 0.6 per cent.

On an annual basis, prices were 8.5 per cent higher in the three months to April compared to 8.1 per cent in the three months to March, the latest figures from Halifax reveal.

Separate data from the Council of Mortgage Lenders shows in the first three months of the year, first-time buyers took out 61,300 loans – down 24 per cent on the fourth quarter of 2014 and 11 per cent down on the first quarter of 2014.

Home movers took out 70,400 loans, a decrease of 25 per cent compared to the fourth quarter 2014 and a decrease of 11 per cent year-on-year.

Mark Harris, chief of mortgage broker SPF Private Clients, said: ‘Mortgage lending got off to a slow start this year but started to pick up by March and with the uncertainty created by the election now resolved, we expect that trend to continue.’

Elsewhere, the ONS figures show that in March, prices paid by first-time buyers were 7.8 per cent higher on average than in March 2014. For existing owners, prices increased by 10.3 per cent for the same period.

Source (http://www.thisismoney.co.uk)